Cup: An OR/MS

Analytics

Challenge

We all have dreams. Building a home; growing a business; traveling; sending children to college; retiring comfortably. To realize these dreams, people and businesses often turn to the financial markets to help protect and grow their assets. Unfortunately, the value of stocks, bonds, and other securities fluctuates with market conditions. There are no guarantees.

Consequently, businesses, individuals, and even governments partner with experts such as Principal® to help find the best investments to achieve their goals. As the world grows smaller through commerce and technology, it’s important to have the most objective and informed perspectives to determine when and where to invest.

Analysts rely on a mix of quantitative and qualitative methodology to create investment theses and recommendations to buy, sell, or hold the stocks in their domain. Portfolio managers, along with their arsenal of portfolio construction tools, make the final decision to allocate the portfolio’s funds to each stock in the investible universe.

There are several sources of information that shape an analyst or portfolio manager’s view of a company. Information from financial statements and historic price changes drive proprietary signals that bias decisions toward fundamentally sound stocks. The stream of news, social media, and reports from banks and brokers provides an indicator of market sentiment and consensus expectations. For most stocks in most instances, this information leads to gradual changes in the market’s belief about a company.

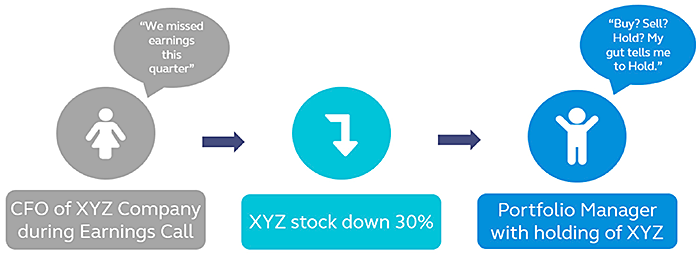

Periodically, a company will experience an event that abruptly changes the market’s expectation and creates a large change in the share price. A company’s beloved CEO announces retirement and the stock drops 10% or a big earnings beat indicates a recovery and the stock jumps 40%. Whether positive or negative, speculative or fundamental, these significant events disrupt the prior beliefs of an analyst or portfolio manager. They must quickly re-evaluate the situation and determine the best action moving forward.

During these critical moments, emotions and biases are present that erode one’s ability to make intelligent decisions. After a negative event, a portfolio manager will be upset about the impact on the portfolio and worried about potentially losing a client. The analyst who recommended buying the stock may be worried about their reputation and fearful of ever recommending similar investments again, even if it is the right choice. Positive events can also cloud their judgment. Both parties may become complacent after their reasoning was “proven” correct and continue to hold or buy more or the same stock. It is entirely possible that the price surge after the event was the peak and best time to sell. These situations require an objective framework to mitigate emotional responses and lead analysts and portfolio managers to decisions that will create the most value for their clients.

The goal of this challenge is to create an objective decision-making process that recommends the optimal action to buy, sell, or hold a stock after it experiences an event. Participants are provided with data from 2010 to 2017 that characterizes company fundamentals, recent price movement, and the nature of the events. To assess performance, the stock’s excess returns are provided from 20 to 60 trading days after the event.

There are several approaches that are relevant and novel solutions are highly encouraged. One approach could run simulations to discover profitable heuristics, another may predict the outcome using machine learning algorithms, and a third may discover an optimal decision policy using dynamic programming or reinforcement learning.

Solutions could also go beyond a single recommendation and consider more complex strategies. As a fake and unsupported example, the optimal policy may be to sell the stock immediately after the event and buy it 30 days later. We also encourage solutions that quantify uncertainty and consider the costs of different types of errors. Buying a stock that should have been sold may be costlier than selling a stock that was a buy. Participants could also consider costs that are highly important but less tangible in nature, such as the firm’s reputation or losing a client. As is human nature, clients will actively remember the instances where a stock was bought that led to significant losses and likely forget or not realize the decision to not buy a stock that led to significant gains.

Teams are provided with data for a set of global stock events from 2010 to 2017. There are four types of data provided:

The datasets and data dictionary can be downloaded upon registration.

The following items are required for an eligible submission:

Finalists teams will also present their solution to a panel of judges at the challenge event at the University of Michigan on September 28th, 2018.

Additional background information, datasets, and tips for getting started will be made available to registered participants after the challenge launches on July 15th, 2018.